Canons of Taxation meaning

It refers to the administrative aspects of a tax, such as the amount, method of levy and collection, and rate of tax, among others. The characteristics or qualities which a good tax should have or functions. Or it can be said that the rules and principles of good tax should be posed.

Canons of Taxation are described as the characteristics or qualities which a good tax should possess.

In the book The Wealth of Nations, written by Adam Smith and published in the year 1776, he argued that taxation should follow four principles. It must be remembered that cannons refer to the qualities of an isolated tax and not to the tax system as a whole. A good tax system should have a proper combination of all kinds of taxes having different cannons.

There are four canons or maxims of Taxation as per Adam Smith. They are the Canon of Ability, the Canon of Certainty, the Canon of Convenience, and the Canon of Economy.

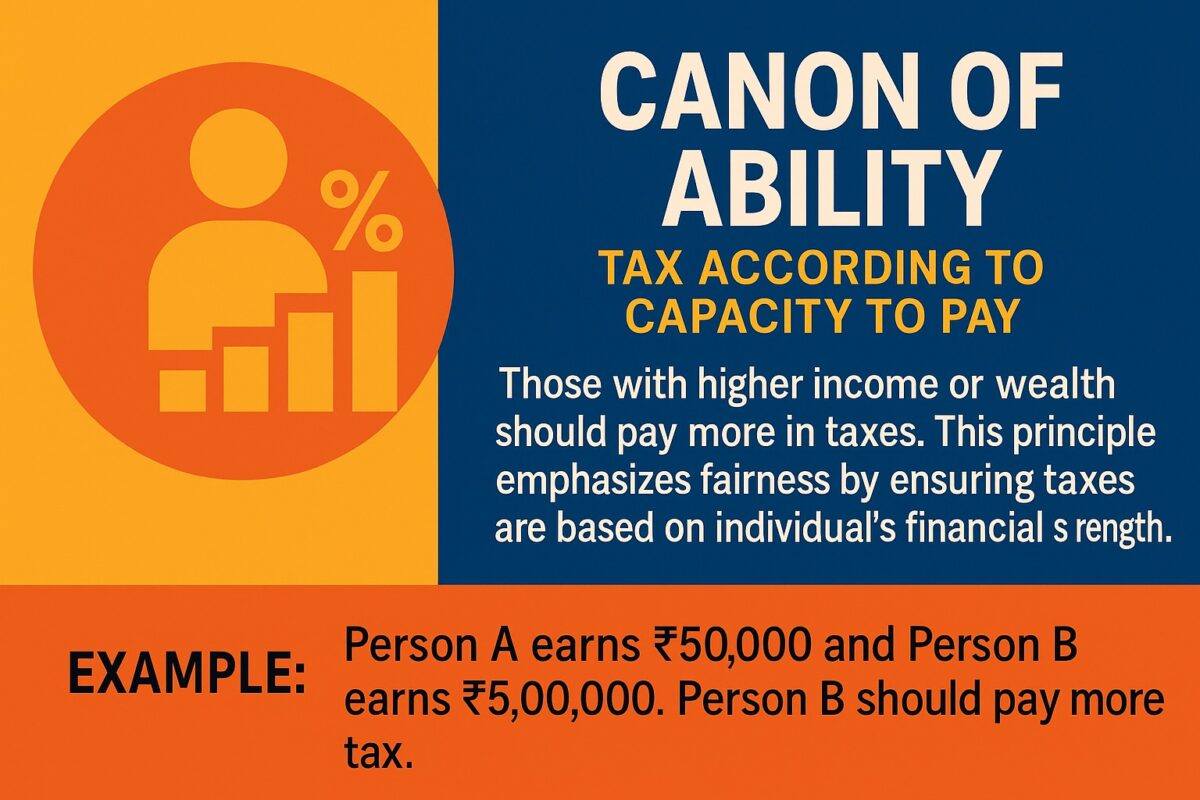

Canon of Ability

“The Canon of Ability says that the government should impose taxes in such a way that people have to pay taxes according to their ability. That is, the rich person should pay more tax compared to a middle-class person or a poor person.”

The Canon of Ability is a principle of taxation that emphasises that individuals should be taxed according to their capacity to pay. This means that those who earn more or own more wealth should contribute a higher amount in taxes. The idea is rooted in fairness and equity, recognising that people with higher income or wealth can afford to bear a greater tax burden without affecting their standard of living, unlike lower-income individuals for whom even small taxes can be burdensome. Canon of Ability is one most important canons of taxation

Example: Suppose there are two individuals—Person A earns ₹50,000 per month, and Person B earns ₹5,00,000 per month. Under the Canon of Ability, Person B should pay more tax, not just in amount but also possibly at a higher rate (progressive taxation). For instance, Person A might pay 5% tax, while Person B pays 30%. This way, the tax system becomes more just, ensuring that public resources are collected in a way that considers people’s financial strength.

Canon of Certainty

“The second Canon of taxation is Certainty. It says that the government must ensure that there is no uncertainty regarding the rate of tax or the time of payment. If the government collects taxes arbitrarily, that is on the basis of random choice or personal whim, rather than any reason or system, then this will adversely affect the efficiency of the people and their working ability too”.

The Canon of Certainty is a principle of taxation introduced by Adam Smith, which states that the tax a person is required to pay should be clear, fixed, and certain, not arbitrary. The taxpayer should know in advance how much tax is to be paid, when it is to be paid, and in what manner. This removes confusion and prevents corruption, misuse of power, or exploitation by tax collectors. Certainty in taxation also builds trust between the government and the public.

Example: Suppose a person owns a shop and has to pay GST (Goods and Services Tax). The tax rate is clearly defined—for example, 18% on certain goods. The shopkeeper knows exactly how much tax to charge and pay, by when, and through which method (like online payment). This clarity makes the process smooth. If the rates were vague or changed without notice, it would create confusion and lead to evasion or manipulation. Hence, the Canon of Certainty ensures transparency and predictability in the tax system.

Canon of Convenience

“The third Canon of taxation is convenience, where the method of tax collection and timing of the tax payment should suit the convenience of the people. The government should make convenient arrangements for all taxpayers to pay taxes without any difficulties”.

The Canon of Convenience is a principle of taxation given by Adam Smith, which states that taxes should be collected in a manner and at a time that is most convenient for the taxpayer. The aim is to reduce the burden and difficulty of paying taxes, making it easier for people to comply. A convenient tax system encourages timely payments and reduces resistance or evasion, ultimately improving tax collection efficiency.

Example: In India, income tax is generally deducted at source (TDS) from an employee’s salary every month. This is a convenient method because the taxpayer does not have to calculate and pay the tax separately—it is automatically handled by the employer. Similarly, property taxes are often collected annually, giving enough time for planning. Such convenient methods reduce stress for taxpayers and ensure steady revenue for the government.

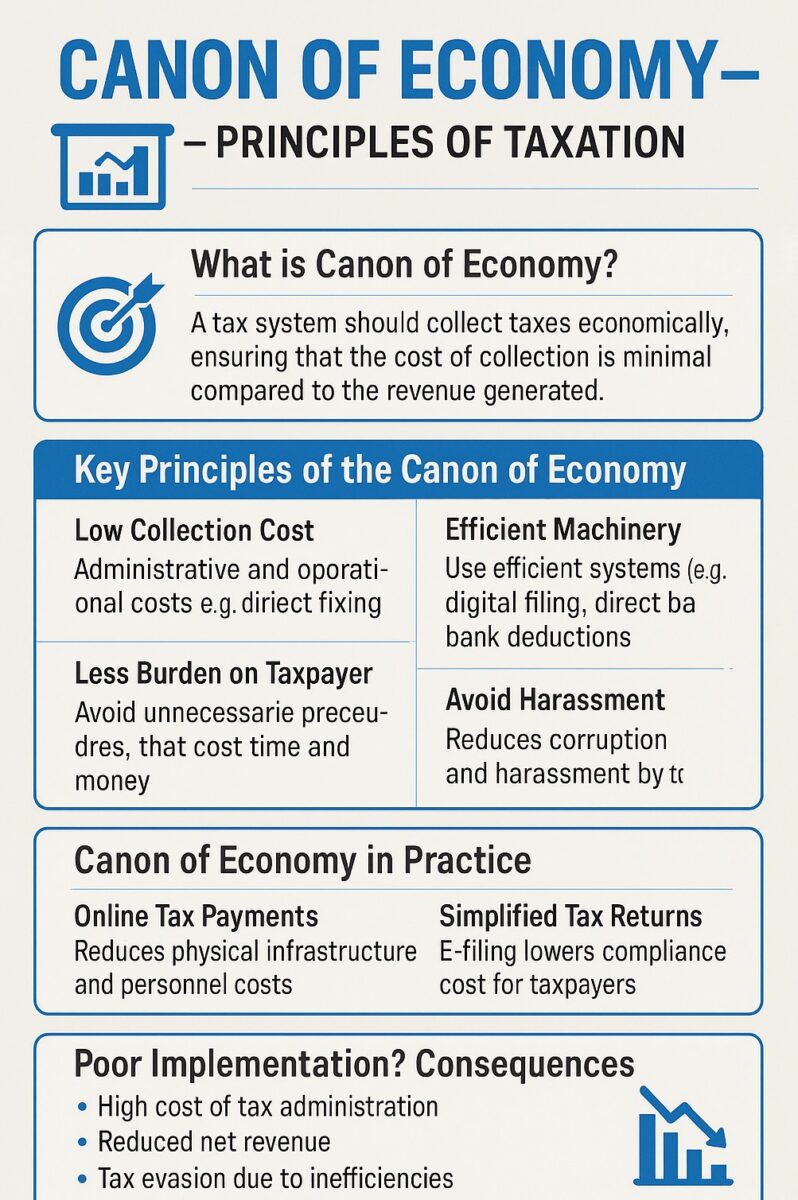

Canon of Economy

“The government needs to spend money collecting taxes. For example, salaries are given to the people who are responsible for collecting taxes. The taxes where the collection cost is more are considered as bad taxes. As per Adam Smith, the government should impose only those taxes whose collection costs are very less and cheap.“

The canon of economy is one most discussed canons of taxation. It is a taxation principle introduced by Adam Smith, which states that the cost of collecting a tax should be minimal compared to the revenue it generates. In other words, the tax system should be economical and efficient, ensuring that a large portion of the collected tax reaches the government without being spent on administration or collection processes. This helps in maximising public benefit from the tax revenue.

Example: Consider the collection of Goods and Services Tax (GST) in India. It is largely digitised and automated, reducing the need for a large workforce or complex procedures. This minimises administrative costs and human errors, making the system more economical. On the other hand, if a government spends ₹10 to collect ₹100 in tax, it would be inefficient. Thus, the Canon of Economy ensures that tax collection is cost-effective and does not waste public resources.

Conclusion

The Canons of Taxation, as proposed by Adam Smith, provide a strong foundation for designing a fair, efficient, and effective tax system. The principles of Ability, Certainty, Convenience, and Economy ensure that taxation is just, predictable, easy to comply with, and cost-effective. When these canons are properly implemented, they help build trust between the government and citizens, encourage voluntary compliance, and ensure that public revenue is collected in a manner that supports economic growth and social welfare. A well-balanced tax system guided by these canons is essential for the stability and development of any nation.